Finpeg is India’s only app to offer intelligent investing in Mutual Funds

- Intelligent Asset Allocation based on Machine Learning Algorithms

- Offers 3% - 4% Extra Returns than regular SIPs in Mutual Funds

- Automated management of your portfolio

- Dedicated relationship manager.

- Free & Unlimited portfolio checkup & advice

Investment solutions for all financial goals

- Want to save for retirement or any other goal? Finpeg offers a far superior solution than SIPs. Start AlphaSIP & earn up to 3%-4% extra returns

- Want to invest lumpsum? Don’t know how much to invest in equity and how much in debt. Let Finpeg’s Smart Lumpsum Solution decide that for you. Invest more in equity when markets are low and more in debt when markets are high.

- Want a steady monthly cash flow? Finpeg’s OnePM offers a cash flow of 1% pm on the invested corpus protecting your original investment.

Best mutual funds selected through proprietary CRAFT framework

With the CRAFT framework, we select the funds that have showcased long-term track record of consistent performance.

Paperless onboarding and automated execution

- Get started with your investments in less than 5 minutes. No paperwork.

- Forget clumsy KYC forms. Paperless online KYC solution.

- And once you get started, the entire execution is completely automated and seamless. Just sit back, relax and watch your money grow.

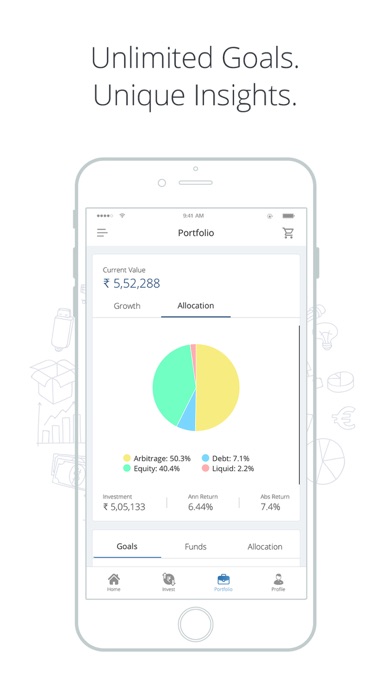

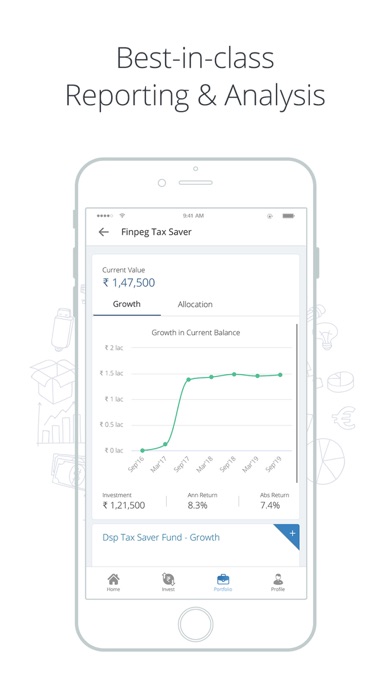

Best-in-class transaction experience and portfolio analytics

- A single-click interface to buy and sell funds.

- Transact in multiple funds in one go. As simple as online shopping!

- For DIY investors, pre-defined screeners to help you select the right mutual funds.

- Track your portfolio in real-time.

- Best-in-class analytics on your portfolio. Drills down to the level of individual holdings and sectoral exposures.

Invest in all types of mutual funds

Finpeg offers all types of mutual funds:

- Equity Mutual Funds

- Large Cap Mutual Funds

- Multi Cap Mutual Funds

- Mid Cap Funds

- Small Cap Mutual Funds

- Debt Mutual Funds

- Aggressive Hybrid Funds

- Conservative Hybrid Funds

- Arbitrage Mutual Funds

- Liquid Mutual Funds

- ELSS Tax Saving Mutual Funds

Schemes of all mutual fund houses are available

- HDFC Mutual Fund

- ICICI Prudential Mutual Fund

- Birla Sun Life Mutual Fund

- SBI Mutual Fund

- L&T Mutual Fund

- Franklin Templeton Mutual Fund

- Reliance Mutual Fund

- Mirae Asset Mutual Fund

- Axis Mutual Fund

- Kotak Mutual Fund

Bank grade security and privacy

- Hosted on Amazon Web Services, all sensitive client data is encrypted and stored with 256 bit SHA encryption.

- Furthermore, Bombay Stock Exchange (BSE) is our backend partner and all the transactions are executed through BSE’s StarMF platform.

- We never share personal data with any third party.

How does Finpeg offers better returns than other apps?

It’s the magic of applying machine learning to the investing methodology.

When you do an SIP, all you are doing is investing in actively managed funds. The investing strategy itself is passive.

1. There is no intelligent tactical asset allocation and rebalancing.

2. There is no portfolio optimization. You are stuck with the same funds.

3. There is no intelligent exit strategy.

Our algorithms provide an intelligent management of your portfolio that delivers alpha returns.

The 4 pillars of our investment strategies are as follows:

1. Intelligent Fund Selection

2. Intelligent Entry - Unlike SIPs, our algorithms have been trained to get the best possible entry for every monthly instalment.

3. Intelligent Rebalancing - Using inputs like PE ratio, PB ratio, Interest Rates, we decide the most optimal asset allocation at any point of time.

4. Intelligent Exit - Our exit strategy ensures that you sell at the highest possible prices.